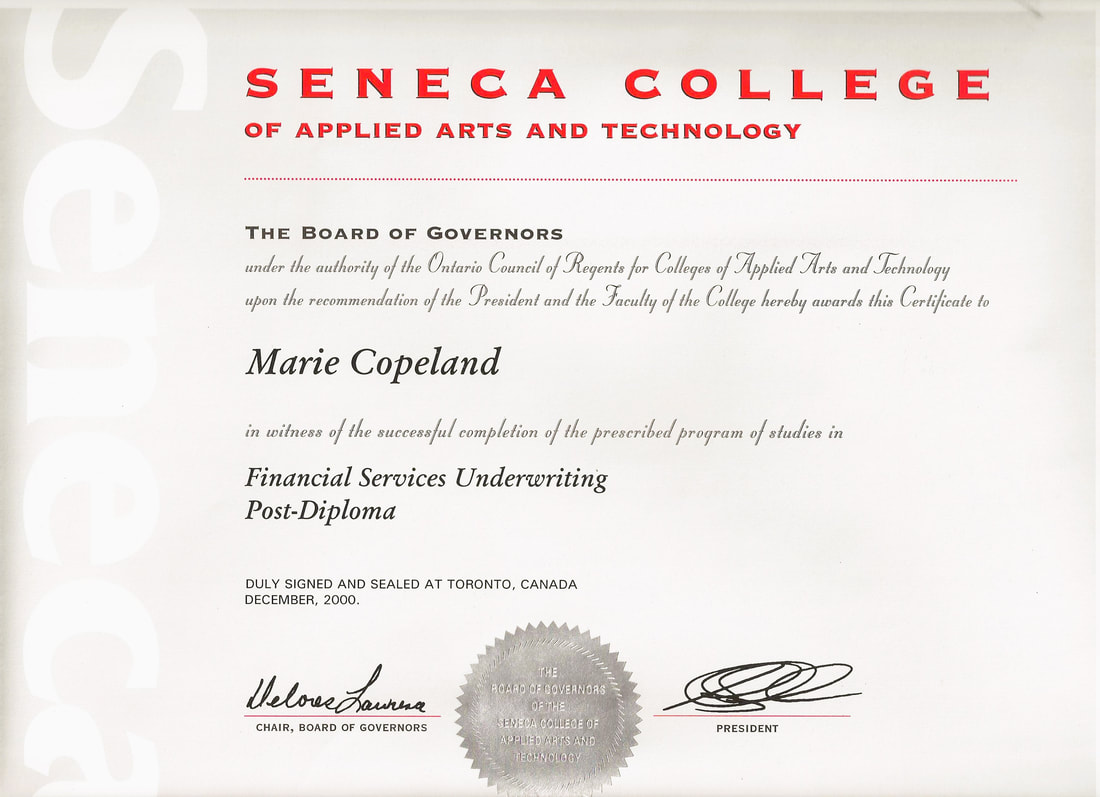

Meet Marie Copeland

|

I'm here to work for you not the big banks. Getting you bank or alternative financing for home purchase or refinancing a home mortgage is more than a job. It's a passion to help families and small business owners realize their real estate financing dreams. |